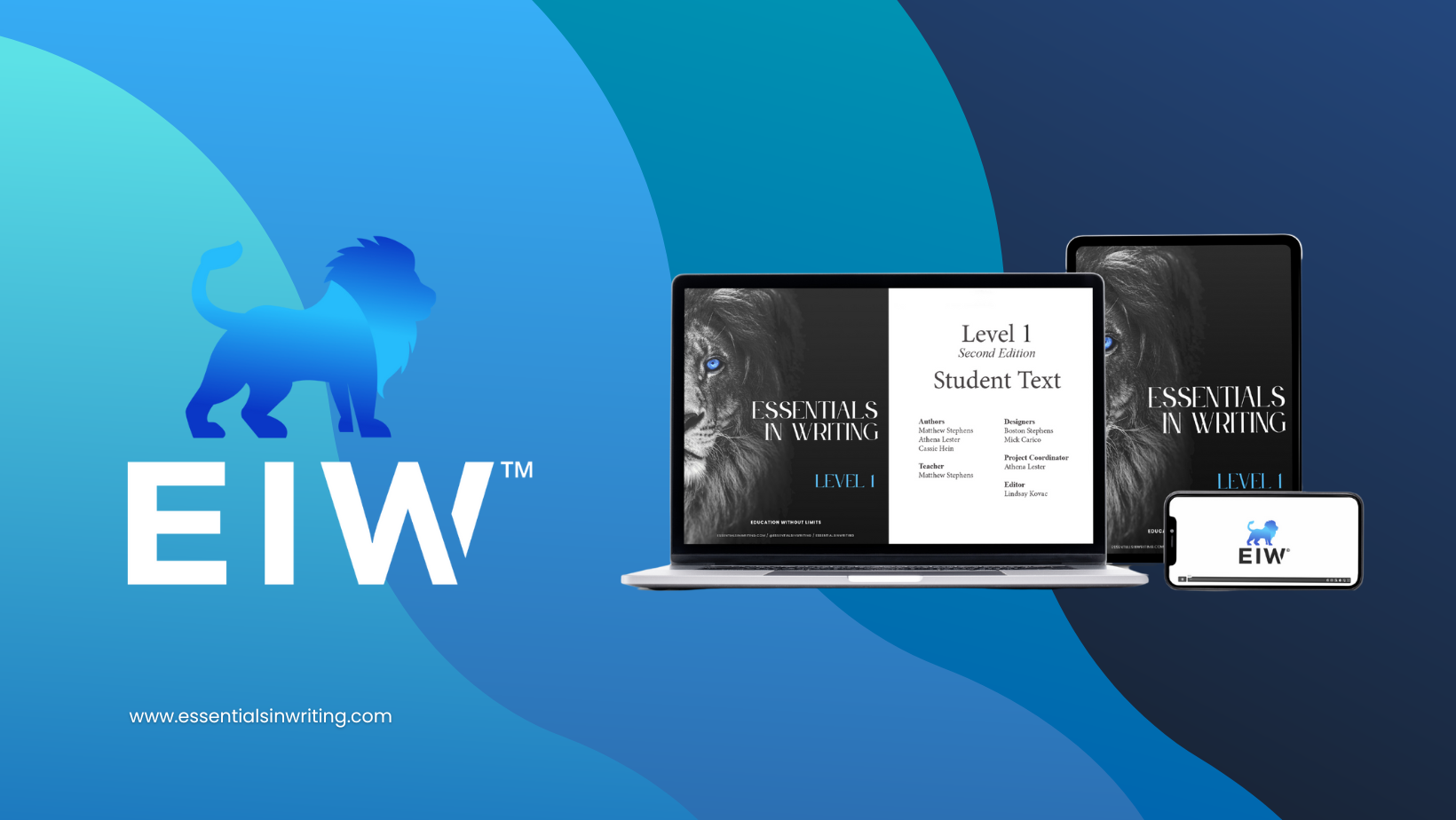

澳洲5开奖官网直播现场 168正规官网 168澳洲幸运5官方开奖历史记录 结果号码查询 Comprehensive K-12 Writing

and Literature Curriculum

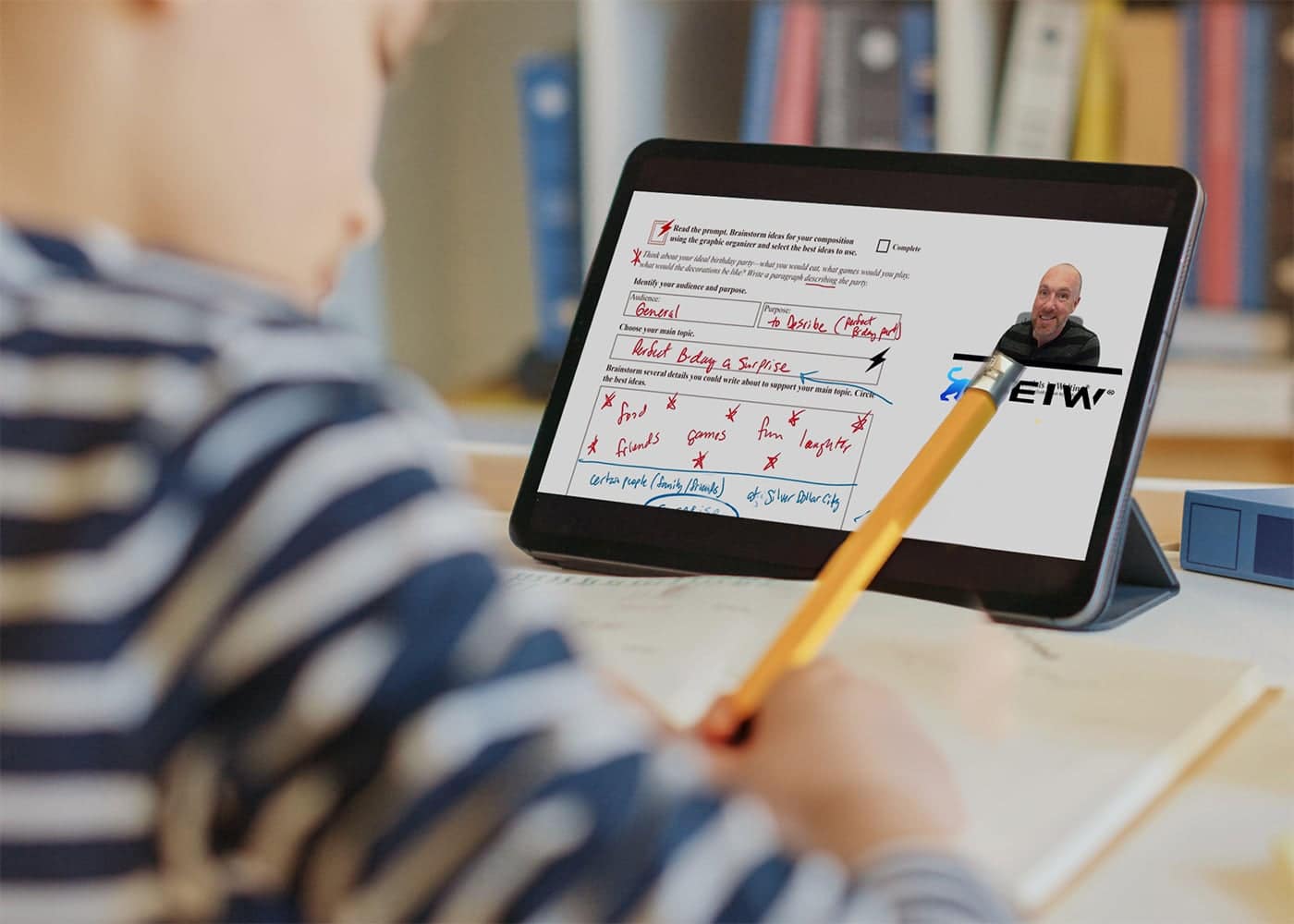

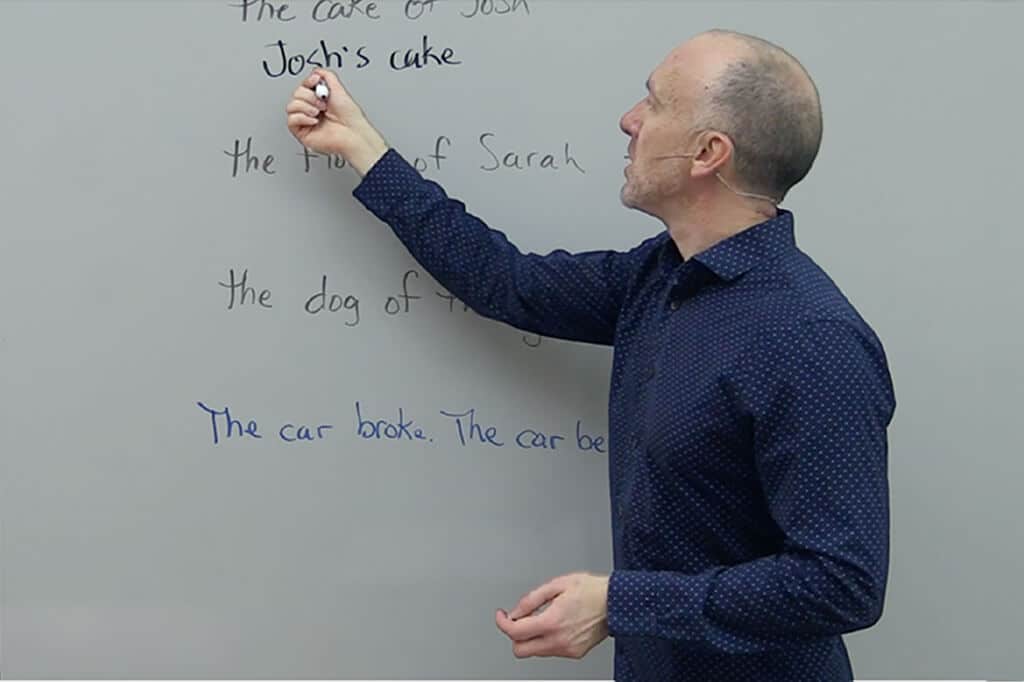

Interactive Video Lessons Tailored to Foster Writing Mastery in Home, Public, and Charter School Students